Dog Insurance Comparison: Finding the Right Paw-tection for Your Friend

Introduction: That Worry in Your Heart

You know that feeling, right?

That little pang of worry when your furry best friend seems a bit off, maybe limping slightly after a tumble at the park, or just not their usual bouncy self.

Your mind instantly jumps to the worst – what if it’s serious? And right behind that thought comes another: how much will the vet visit cost?

We pour so much love into our dogs; they’re family. Seeing them hurt or sick is heartbreaking, and the added stress about unexpected vet bills can feel overwhelming. You’d do anything for them, but sometimes the cost of care can be a real challenge. That’s where thinking about a safety net, like pet insurance, comes in.

Making a dog insurance comparison might seem like just another task on your long list, but it’s really about finding peace of mind, knowing you have help covering those unexpected costs so you can focus on what truly matters – your dog’s health and happiness.

Navigating the world of pet insurance can feel confusing at first. So many companies, different plans, and terms you might not recognize. What’s covered?

What isn’t?

How much does it really cost?

This guide is here to walk you through it, simply and clearly. We’ll break down how to compare dog insurance plans effectively, look at what different providers offer, and help you figure out what kind of coverage makes the most sense for you and your beloved companion.

Let’s explore how you can find the right protection without the headache.

Understanding the Basics: What Exactly is Dog Insurance?

Think of dog insurance like health insurance for your furry pal. You pay a regular amount, called a premium (usually monthly), to an insurance company. In return, if your dog gets unexpectedly sick or injured, the insurance helps cover a portion of the eligible vet bills. It’s designed to protect you from those sudden, large expenses that can pop up without warning.

It’s important to know it doesn’t usually cover everything. Most plans focus on accidents (like a broken bone from a fall) and illnesses (like infections or cancer). Routine care, such as annual check-ups, vaccinations, or flea/tick prevention, often isn’t covered by standard plans, though some companies offer optional wellness riders or packages you can add on for an extra cost.

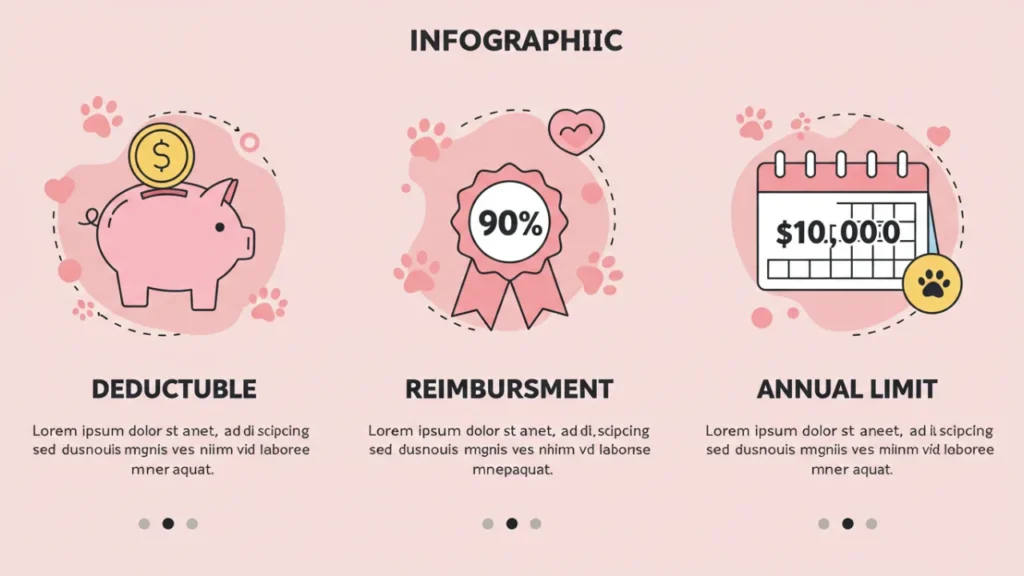

Here are a few key terms you’ll see when doing your dog insurance comparison:

Deductible: This is the amount you need to pay out-of-pocket for vet care before the insurance starts chipping in. Deductibles can be annual (you meet it once per policy year) or per-incident (you meet it for each new condition). Choosing a higher deductible usually means a lower monthly premium, but you’ll pay more upfront if something happens.

Reimbursement Level: After you meet your deductible, the insurance company pays back a percentage of the covered vet bill. This is the reimbursement level, often ranging from 70% to 90%, though some plans might offer 100% or lower options like 50% or 60%. A higher reimbursement level means the insurance covers more, but your premium might be higher.

Annual Limit (or Maximum Payout): This is the maximum amount the insurance company will pay out for covered claims within a policy year. Some plans have limits per condition, while others have an overall annual limit. Many providers now offer plans with unlimited annual payouts, which can be crucial for very serious or chronic conditions.

Understanding these basics is the first step in making an informed choice. It helps you see how different plans might work for your budget and your dog’s potential needs.

What Kinds of Dog Insurance Plans Are There?

When you start looking, you’ll find there are generally a few main types of dog insurance plans. Knowing the difference is key to finding what fits your needs best.

Accident-Only Plans: These are usually the most basic and often the cheapest option. As the name suggests, they only cover vet bills related to accidents – things like your dog getting hit by a car, swallowing something they shouldn’t, or tearing a ligament while playing. They won’t cover illnesses like ear infections, diabetes, or cancer.

Accident & Illness Plans: This is the most common and comprehensive type of pet insurance. It covers both accidental injuries and unexpected illnesses.

This could range from minor issues like vomiting or diarrhea to serious conditions like heart disease or hip dysplasia (if it’s not considered pre-existing). This type of plan offers broader protection and peace of mind for a wider range of health problems.

Wellness or Routine Care Add-ons: Standard insurance plans typically don’t cover preventative care like annual check-ups, vaccinations, spaying/neutering, teeth cleaning, or flea/tick/heartworm prevention. However, many companies offer an optional wellness plan or rider that you can add to your accident and illness policy for an extra monthly cost.

These plans usually provide a set amount of money per year towards specific routine care services. You’ll need to figure out if the extra cost is worth the benefits you expect to use.

Most people looking for solid protection opt for an Accident & Illness plan, as it covers the big, unexpected health issues that can lead to hefty vet bills. Accident-Only might be an option if your budget is very tight, but it leaves a big gap if your dog gets sick.

Key Factors for Your Dog Insurance Comparison

Okay, so you know the basics and the types of plans. Now, how do you actually compare them? Doing a thorough dog insurance comparison involves looking closely at several important details. Don’t just glance at the monthly price! Here’s what to focus on:

- Premiums: This is the monthly or annual cost you pay for the policy. It will vary based on your dog’s breed, age, location, and the coverage options you choose (deductible, reimbursement level, annual limit).

- Deductibles: As we mentioned, this is what you pay first. Compare whether it’s annual or per-incident. An annual deductible is often easier to manage, as you only need to meet it once per policy year, regardless of how many different issues arise.

- Reimbursement Levels: What percentage of the bill will the insurance pay back after the deductible? 80% or 90% are common and offer good coverage, but check the options available.

- Annual Limits: Is there a cap on how much the policy will pay out each year? Unlimited plans offer the most security against catastrophic costs, but plans with high limits (like $10,000 or $20,000) can also be sufficient for many situations. Avoid plans with very low annual limits if possible.

- Waiting Periods: Almost all plans have waiting periods before coverage kicks in. This means you can’t sign up today and make a claim tomorrow. Compare the waiting times for accidents, illnesses, and specific conditions like cruciate ligament issues or hip dysplasia, which often have longer waiting periods (e.g., 6 months).

- Exclusions (Especially Pre-existing Conditions): This is crucial. No pet insurance plan covers pre-existing conditions – health problems your dog showed signs of before the policy started or during the waiting period. Read the fine print carefully to understand what else isn’t covered (e.g., cosmetic procedures, breeding costs, certain hereditary conditions unless specifically included).

- Provider Reputation and Reviews: Look beyond the policy details. What do other customers say about the company? Check online reviews (like on the Better Business Bureau or pet insurance review sites) for insights into customer service, claim processing speed, and overall satisfaction.

Comparing these factors side-by-side for different providers will give you a much clearer picture of the true value each plan offers.

Comparing Some Popular Providers (A Quick Look)

While we can’t tell you exactly which company is best (because the best choice depends on your specific needs and dog), let’s briefly touch on a few well-known names you might encounter during your dog insurance comparison. Remember to get personalized quotes and read their specific policy documents!

- Nationwide (formerly VPI): One of the oldest providers. They offer different types of plans, sometimes including coverage for more exotic pets, and may have options that cover wellness care. See here your Review

- Trupanion: Often known for paying vets directly (if the vet accepts it), which can simplify the claims process. They typically focus on a single, comprehensive accident and illness plan with a 90% reimbursement level and no payout limits, but often use a per-condition deductible.

- Healthy Paws: Frequently praised for quick claim processing and good customer service. They generally offer one simple accident and illness plan with no annual limits and various deductible/reimbursement options.

- Embrace Pet Insurance: Offers flexible accident and illness plans with diminishing deductibles for each year you don’t file a claim. They also provide an optional wellness rewards plan.

- Figo: Known for being tech-friendly with a helpful app. They offer customizable plans, often with options for 100% reimbursement and no upper payout limits.

- Lemonade Pet: A newer player using AI and an app-based approach. They aim for quick claims and offer competitive pricing with preventative care add-ons.

This is just a small sample! Many other great companies exist (like ASPCA Pet Health Insurance, Pets Best, Pumpkin, etc.). The key is to get quotes from several providers that seem like a good fit based on their plan structures and your comparison factors.

How Your Dog’s Details Affect the Cost

It’s not just the plan details that determine the price. Your dog plays a big role too!

- Breed: Some breeds are more prone to certain health issues (like hip dysplasia in larger breeds or breathing problems in flat-faced breeds). Insurance companies know this, so premiums are often higher for breeds with known genetic predispositions to costly conditions.

- Age: Just like with people, the risk of health problems increases as dogs get older. Insuring a puppy is usually much cheaper than insuring a senior dog. Many companies also have age limits for enrolling new pets, especially for illness coverage.

- Location: Vet costs vary significantly depending on where you live (e.g., costs in a major city are often higher than in a rural area). Insurance premiums reflect these local cost differences.

When getting quotes, be sure to provide accurate information about your dog and location to get a realistic price estimate.

Making the Choice: Practical Tips for You

Feeling a bit more confident? Great! Here are a few final tips to help you choose the right plan after you’ve done your initial dog insurance comparison:

- Consider Your Budget: Be realistic about what you can comfortably afford for the monthly premium. Balance this against the potential out-of-pocket costs if you choose a higher deductible or lower reimbursement level.

- Think About Your Dog’s Breed and Health: Does your dog’s breed have known health risks? Are they particularly active and prone to accidents? This might influence whether you prioritize very comprehensive coverage or unlimited payouts.

- Read the Full Policy Document: Don’t rely solely on marketing materials or comparison charts. Download and read the actual sample policy for any plan you’re seriously considering. Pay close attention to the definitions, exclusions, and claim filing process.

- Get Multiple Quotes: Prices and coverage details can vary significantly. Get personalized quotes from at least 3-5 different companies before making a decision.

- Don’t Wait Too Long: It’s generally best to insure your dog when they are young and healthy. Waiting until they develop health problems will likely mean those issues become pre-existing conditions and won’t be covered.

- Check for Discounts: Ask about potential discounts, such as multi-pet discounts if you have more than one furry friend to insure.

Taking the time to weigh these points carefully will help ensure you select a plan that truly provides value and peace of mind for your situation.

Key Takeaways: Your Quick Comparison Checklist

Let’s quickly recap the main things to keep in mind when comparing dog insurance:

- Understand the Basics: Know what premiums, deductibles, reimbursement levels, and annual limits mean.

- Choose the Right Plan Type: Decide between Accident-Only, Accident & Illness (most common), or adding a Wellness plan.

- Compare Key Factors: Look closely at premiums, deductibles (annual vs. per-incident), reimbursement %, annual limits (unlimited is often best), waiting periods, and exclusions (especially pre-existing conditions).

- Research Providers: Check customer reviews and reputation for claim handling and service.

- Consider Your Dog: Breed, age, and your location impact cost and needs.

- Read the Fine Print: Always review the full policy document before enrolling.

- Get Multiple Quotes: Don’t settle on the first option you see.

- Enroll Early: Insure your dog while they are young and healthy if possible.

Conclusion: Investing in Peace of Mind

Choosing dog insurance is a personal decision, and there’s no single right answer for everyone. However, by taking the time to understand the options, carefully conduct your dog insurance comparison, and consider your own financial situation alongside your dog’s needs, you can find a plan that offers valuable protection.

It’s about more than just money; it’s about having the resources to give your beloved companion the best possible care when they need it most, without adding financial hardship to an already stressful situation.

Making an informed choice now can bring significant peace of mind for all the adventures yet to come with you.

For more insightful articles and tips on pet care and insurance, be sure to explore more at Tech Havela. Your pet’s health is worth it!

**Sidnir Vieira**

Founder of TechHavela

A passionate pet and tech content creator, helping dog owners across the U.S. make smarter decisions for their furry friends.