Cheapest Dog Insurance: Finding Affordable Protection for Your Pet

Introduction: Loving Your Dog Without Breaking the Bank

We all want the best for our dogs, showering them with love, treats, and cozy beds. They’re family, and their health is a top priority. But let’s be honest, vet bills can add up quickly, and sometimes those unexpected costs can put a real strain on our finances. You might be thinking about pet insurance as a safety net, but perhaps the monthly premiums seem like just another expense you’re not sure you can handle. This often leads pet parents to search specifically for the cheapest dog insurance available, hoping to find some level of protection that fits comfortably within their budget.

It’s completely understandable to look for affordable options. You want to be responsible and prepared, but you also need to manage your household expenses. The good news is that finding budget-friendly dog insurance is possible, but it requires careful consideration. “Cheapest” doesn’t always mean “best value,” and it’s crucial to understand what you might be giving up in exchange for a lower price. This guide will help you navigate the search for affordable pet protection. We’ll explore strategies for finding lower-cost plans, explain how different coverage options impact the price, and help you weigh the balance between cost and coverage to find the most sensible and affordable dog insurance for your beloved companion.

Summary

What Makes Dog Insurance Cost More (or Less)?

Understanding the factors that influence the price is the first step in finding more affordable options. Insurance premiums aren’t random; they’re calculated based on risk. Here’s what typically drives the cost:

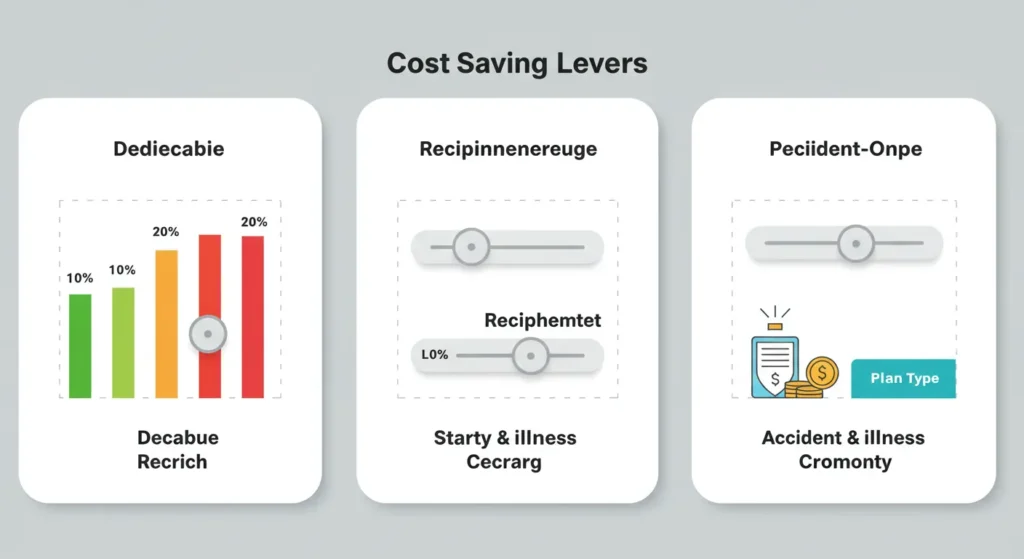

- Coverage Level: This is the biggest factor. Comprehensive Accident & Illness plans cost more than basic Accident-Only plans because they cover a wider range of potential problems. Plans with higher annual payout limits (or unlimited payouts) also cost more than those with lower caps.

- Deductible Amount: The deductible is what you pay out-of-pocket before insurance starts reimbursing. Choosing a higher deductible (e.g., $1000 instead of $250) generally leads to a lower monthly premium. You take on more initial risk in exchange for lower regular payments.

- Reimbursement Percentage: This is the percentage of the vet bill the insurance pays back after you meet the deductible. Choosing a lower reimbursement level (e.g., 70% instead of 90%) usually results in a lower premium. You’ll pay a larger portion of the bill yourself if something happens.

- Dog’s Breed: Some breeds are genetically predisposed to certain expensive health conditions (like hip dysplasia in large breeds or breathing issues in flat-faced breeds). Insuring these breeds often costs more due to the higher likelihood of claims.

- Dog’s Age: Puppies are generally the cheapest to insure. Premiums increase as dogs get older because the risk of illness rises significantly. Enrolling your dog when they are young locks in coverage before potential issues arise (and become pre-existing).

- Your Location: Vet care costs vary geographically. Premiums are typically higher in areas with a higher cost of living and more expensive veterinary services (like major cities).

Knowing these factors helps you see where you might have flexibility to adjust coverage and potentially lower the cost.

Strategies for Finding the Cheapest Dog Insurance

If your primary goal is finding the lowest possible premium, here are some common strategies and options to explore:

- Opt for an Accident-Only Plan: These plans are significantly cheaper than comprehensive Accident & Illness policies because they only cover injuries resulting from accidents. They provide no coverage for illnesses like cancer, infections, or chronic conditions. This is a major trade-off, but it offers basic protection against traumatic injuries at a lower cost.

- Choose a High Deductible: As mentioned, selecting the highest deductible you feel comfortable managing ($500, $750, $1000, or sometimes even higher) will directly reduce your monthly premium. Just be prepared to pay that amount out-of-pocket if a covered event occurs.

- Select a Lower Reimbursement Level: Opting for a 70% or even 50% reimbursement level instead of 80% or 90% will lower your premium. You’ll be responsible for a larger share of the vet bill (30% or 50% after the deductible), but your regular payments will be less.

- Accept a Lower Annual Limit: While unlimited plans offer the most peace of mind, choosing a plan with a set annual payout limit (e.g., $5,000 or $10,000) will usually be cheaper. Assess if this limit provides sufficient coverage for potential major incidents based on vet costs in your area.

- Compare Quotes Extensively: Don’t just get one or two quotes. Prices for similar coverage can vary significantly between insurance providers. Use online comparison tools and get direct quotes from multiple companies (including lesser-known ones) specifically asking for their most budget-friendly options.

- Look for Discounts: Ask providers about potential discounts, such as multi-pet discounts, discounts for paying annually instead of monthly, or discounts through employers or associations.

Combining some of these strategies (e.g., a higher deductible and a lower reimbursement level) can lead to finding some of the cheapest dog insurance premiums available.

The Downsides: What You Might Sacrifice for the Lowest Price

While finding the cheapest dog insurance is appealing, it’s crucial to understand the potential trade-offs. Opting for the absolute lowest premium often means accepting limitations that could leave you underinsured when you need help most:

- Limited Coverage Scope: Accident-Only plans, while cheap, offer zero protection against common and often costly illnesses. Even some budget Accident & Illness plans might have more exclusions or stricter definitions for covered conditions.

- High Out-of-Pocket Costs: A very high deductible means you’ll pay a significant amount upfront before insurance contributes anything. Similarly, a low reimbursement percentage (like 50%) means you still pay half the bill even after meeting the deductible. This might not provide the financial relief you were hoping for in a major emergency.

- Low Annual Limits: Plans with low annual caps (e.g., $2,000 or $5,000) can be quickly exhausted by a single serious incident, like surgery for a foreign object removal or treatment for a broken leg. You’d be responsible for all costs exceeding that limit within the policy year.

- Longer Waiting Periods or More Exclusions: Some budget plans might impose longer waiting periods for certain conditions or have a more extensive list of exclusions, particularly regarding hereditary issues.

Saving money on the premium is great, but not if the policy fails to provide meaningful financial assistance when a large vet bill arrives. The goal is affordable protection, not just a cheap policy.

Balancing Cost and Value: Finding Affordable and Effective Coverage

Instead of just seeking the absolute cheapest dog insurance, aim for the best value within your budget. This means finding a plan that offers a reasonable level of protection at a price you can sustain. Here’s how to approach it:

- Prioritize Accident & Illness: Unless your budget is extremely tight, an Accident & Illness plan generally offers much better value than Accident-Only, as illnesses are common and can be very expensive.

- Adjust Deductible/Reimbursement Wisely: Find a balance. Maybe a $500 deductible with 80% reimbursement is more manageable overall than a $1000 deductible with 70% reimbursement, even if the premium is slightly higher. Consider your savings and ability to cover the deductible.

- Look for Decent Annual Limits: Aim for an annual limit of at least $10,000 if unlimited plans are out of reach. This provides a more substantial safety net than very low limits.

- Compare “Apples to Apples”: When getting quotes, try to compare plans with similar deductibles, reimbursement levels, and limits to see which company offers the best price for that specific level of coverage.

- Read Reviews for Budget Providers: If considering a lesser-known or budget-focused provider, pay extra attention to customer reviews regarding claim payouts and service. Sometimes, lower prices come with administrative headaches.

Finding affordable dog insurance often involves making compromises, but focus on maintaining a core level of meaningful coverage rather than stripping it down to the bare minimum just to save a few dollars on the premium.

Key Takeaways: Smart Shopping for Affordable Dog Insurance

Finding budget-friendly protection involves strategic choices:

- Understand Cost Factors: Coverage level, deductible, reimbursement, breed, age, and location all impact price.

- Lowering Premiums: Consider higher deductibles, lower reimbursement levels, or limited annual payouts.

- Accident-Only is Cheapest (But Limited): Offers basic injury protection but no illness coverage.

- Compare Extensively: Get quotes from multiple providers for similar coverage levels.

- Beware the Trade-offs: Extremely cheap plans may have significant coverage gaps or high out-of-pocket costs.

- Aim for Value: Balance affordability with meaningful coverage (Accident & Illness, reasonable limits).

- Read the Details: Always understand the exclusions and limits of any budget plan.

Conclusion: Affordable Protection is Possible

Searching for the cheapest dog insurance is a practical necessity for many loving pet owners. While the absolute lowest price might come with significant compromises, finding truly affordable and valuable protection is achievable. By understanding how premiums are set, strategically adjusting coverage options like deductibles and reimbursement levels, and comparing quotes diligently, you can find a plan that fits your budget without leaving your furry friend critically underinsured. The key is to balance cost savings with effective coverage, ensuring your chosen policy provides a genuine safety net for those unexpected vet visits. Making an informed, budget-conscious choice allows you to protect both your pet and your finances.

For more insightful articles and tips on pet care and insurance, be sure to explore more at Tech Havela. Your pet’s health is worth it!

**Sidnir Vieira**

Founder of TechHavela

A passionate pet and tech content creator, helping dog owners across the U.S. make smarter decisions for their furry friends.