Nationwide Pet Insurance Review (Formerly VPI): A Look at Coverage & Plans

A Familiar Name in Pet Protection

When you start exploring the world of pet insurance, certain names pop up frequently. Nationwide is undoubtedly one of them.

As one of the largest and longest-standing insurance companies in the U.S., many people recognize the name and feel a sense of trust associated with it.

For years, pet parents knew this provider as VPI (Veterinary Pet Insurance), a pioneer in the industry. Now operating under the main Nationwide brand, they continue to be a major player, offering various plans to help manage the costs of veterinary care for dogs, cats, and even exotic pets.

If you’re considering Nationwide pet insurance, you might be wondering how their offerings stack up against competitors and whether their long history translates into the best coverage for your furry friend.

Perhaps you remember the VPI name or have Nationwide insurance for your home or car and are curious about bundling pet coverage. Or maybe you’re just starting your search and want to understand what established providers like Nationwide offer.

What types of plans do they have? Is Nationwide dog insurance comprehensive? What about the cost and customer experience?

This review will delve into the specifics of Nationwide’s pet insurance offerings, examining their different coverage options, typical costs, benefits, and potential drawbacks, helping you determine if this well-known insurer is the right choice for protecting your beloved pet.

Summary

Nationwide Pet Insurance: Plan Options Explored

Nationwide offers a few different approaches to pet insurance, which can be both a benefit (more choice) and a bit confusing compared to companies with simpler offerings.

Here’s a general overview of the types of plans you might encounter (note that specific plan names and details can change, so always check their current offerings):

- Major Medical Plans (Accident & Illness): This is their core offering, designed to cover unexpected injuries and illnesses. These plans typically function like traditional pet insurance, reimbursing a percentage of the vet bill after a deductible. They often come with different levels of coverage or customization options regarding deductibles, reimbursement percentages, and annual limits.

- Wellness Plans (Routine Care Add-on): Nationwide often provides optional wellness riders that can be added to their Major Medical plans. These help budget for preventative care like check-ups, vaccinations, flea/tick prevention, and sometimes services like spaying/neutering or dental cleanings. They work based on a benefit schedule, offering a set allowance for specific services per year.

- Whole Pet® with Wellness Plan: This has historically been one of Nationwide’s more comprehensive options, often bundling accident, illness, and wellness coverage into a single plan. It might cover a wider range of conditions, including hereditary issues, and provide benefits for routine care, usually based on a percentage reimbursement (like 90%) after a deductible, which is different from typical add-on wellness riders.

- Avian & Exotic Pet Plan: A unique offering from Nationwide (stemming from its VPI roots) is insurance specifically for birds and exotic pets (like reptiles, rabbits, ferrets, etc.). This is a niche not covered by most other pet insurance companies.

When getting a quote for Nationwide pet insurance, it’s crucial to understand which specific plan type you are being offered and exactly what it includes and excludes.

Coverage Details: What Does Nationwide Dog Insurance Include?

Focusing on their typical Major Medical or Whole Pet® type plans for dogs, here’s what Nationwide dog insurance generally aims to cover:

- Accidents: Injuries like broken bones, cuts, poisonings, etc.

- Illnesses: Sicknesses such as infections, cancer, diabetes, allergies, etc.

- Hereditary & Congenital Conditions: Coverage for conditions like hip dysplasia, cherry eye, or heart defects often depends on the specific plan chosen. Some plans may include it, while others might have limitations or exclusions, especially basic plans.

- Diagnostic Tests: X-rays, blood work, ultrasounds, etc., related to covered conditions.

- Surgeries: Procedures needed for covered accidents or illnesses.

- Hospitalization: Stays at the vet clinic.

- Prescription Medications: Drugs prescribed for covered conditions.

- Emergency Care: Visits to emergency vet clinics.

Key Considerations for Nationwide Coverage:

- Benefit Schedules vs. Percentage Reimbursement: Historically, some VPI/Nationwide plans used a benefit schedule. This means the plan paid a set, predetermined amount for specific conditions or procedures, regardless of the actual vet bill. This is less common now, as most top insurers (including newer Nationwide plans) use percentage reimbursement (paying a % of the actual bill). It is vital to clarify whether a plan uses a benefit schedule or percentage reimbursement, as benefit schedules can lead to significant out-of-pocket costs if the vet charges more than the scheduled amount.

- Wellness Coverage: If you opt for a wellness rider or a bundled plan like Whole Pet®, understand the specific allowances or reimbursement details for routine care.

- Exclusions: Like all insurers, Nationwide excludes pre-existing conditions. Pay attention to other exclusions listed in the policy, which might include certain elective procedures, breeding costs, or specific conditions depending on the plan.

Nationwide Pet Insurance Cost: What to Expect

The cost of Nationwide pet insurance varies widely based on several factors, just like with any provider:

- Plan Choice: More comprehensive plans like Whole Pet® will cost significantly more than basic Major Medical plans or wellness riders alone.

- Coverage Customization: Your chosen deductible, reimbursement level (if applicable), and annual limit directly impact the premium.

- Pet Details: Your dog’s breed, age, and your geographic location heavily influence the price.

Generally, Nationwide’s premiums can range from affordable for basic plans or young pets to quite expensive for comprehensive coverage, older pets, or certain breeds. Because they offer different plan structures (including potential benefit schedules on older or basic plans vs. percentage reimbursement on others), it’s essential to get a personalized quote and understand exactly how that specific plan calculates costs and reimbursements to determine the true value.

Compared to some newer, app-based insurers, Nationwide might not always be the absolute cheapest option, but their brand recognition and potentially broader coverage (like for exotic pets) are part of their value proposition.

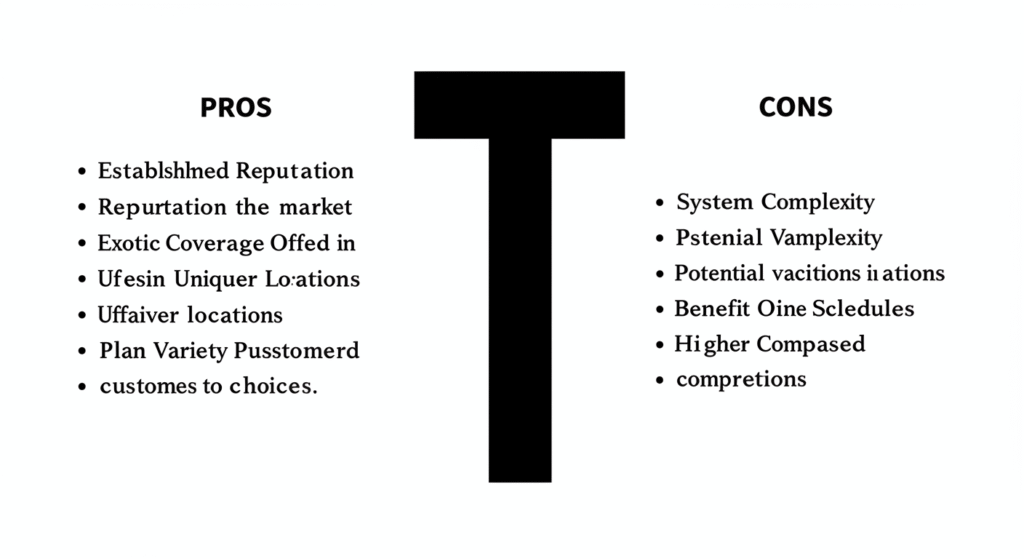

Pros and Cons of Nationwide Pet Insurance

Based on their offerings and reputation, here’s a summary of potential advantages and disadvantages:

Pros:

- Established Company: Nationwide is a large, financially stable insurance company with a long history (including its VPI roots).

- Variety of Plans: Offers different types of plans, potentially catering to various needs and budgets.

- Covers Avian & Exotic Pets: One of the few major providers offering plans for pets other than dogs and cats.

- Optional Wellness Coverage: Provides riders or bundled plans that include routine care benefits.

- Potential Bundling Discounts: Existing Nationwide customers might be eligible for discounts.

Cons:

- Potentially Complex Plan Structures: The variety of plans, and the historical use of benefit schedules on some, can make comparisons confusing. You must clarify the reimbursement method (benefit schedule vs. percentage of actual bill).

- Benefit Schedule Limitations (if applicable): If a plan uses a benefit schedule, payouts might not cover the full vet cost if your vet charges more than the scheduled amount.

- May Not Be the Cheapest: Comprehensive plans can be more expensive than some competitors.

- Mixed Customer Reviews: Like many large companies, online reviews can be mixed, with some customers praising service and others reporting issues with claim processing or coverage interpretations.

Customer Reviews and Reputation

Online reviews for Nationwide pet insurance (and its VPI history) are varied. Some customers report positive experiences, easy claim filing (especially through their online portal or app), and helpful customer service. Others mention frustrations with claim denials, confusion over benefit schedules (on older plans), or slower processing times compared to some newer competitors.

As with any insurance, it’s wise to read recent reviews from multiple independent sources (like the Better Business Bureau, Trustpilot, or dedicated pet insurance review sites) to get a balanced perspective. Pay attention to comments specifically related to the type of plan you are considering.

Is Nationwide Pet Insurance Right for You?

Nationwide could be a good choice if:

- You value the security of a large, established insurance company.

- You have an exotic pet that other insurers don’t cover.

- You are interested in bundled wellness coverage and prefer Nationwide’s approach.

- You are an existing Nationwide customer and can benefit from bundling discounts.

- You carefully review the specific plan details (especially the reimbursement method) and find it meets your needs and budget.

It might be less ideal if:

- Your top priority is the absolute lowest premium.

- You prefer a very simple, single-plan offering with straightforward percentage reimbursement and no potential for benefit schedules.

- You find their plan options confusing to compare.

Key Takeaways: Nationwide Pet Insurance Overview

- Provider: Large, established insurer (formerly VPI).

- Plan Types: Offers various options including Major Medical (Accident & Illness), Wellness add-ons, bundled plans (like Whole Pet®), and unique Avian & Exotic Pet plans.

- Coverage: Generally covers accidents, illnesses, diagnostics, treatments. Hereditary condition coverage varies by plan.

- Reimbursement: Crucial to check – may use percentage of actual bill OR a benefit schedule depending on the specific plan.

- Pros: Established company, plan variety, exotic pet coverage, wellness options.

- Cons: Can be complex, potential for benefit schedule limitations, may not be cheapest, mixed reviews.

- Best For: Those valuing a large brand, needing exotic pet coverage, or finding a specific plan structure that fits their needs after careful review.

Conclusion: A Long-Standing Option Worth Considering Carefully

Nationwide pet insurance, with its VPI legacy, remains a significant force in the pet insurance market. Its strengths lie in its brand recognition, financial stability, and unique coverage for exotic pets.

However, the variety of plans and the potential use of different reimbursement methods (percentage vs. benefit schedule) mean prospective customers must do their homework.

Carefully analyze the specific Nationwide dog insurance plan quote you receive, paying close attention to the coverage details, exclusions, and especially how reimbursements are calculated.

While it might not always be the simplest or cheapest option, for pet owners who value a long-standing company or have specific needs met by Nationwide’s diverse offerings, it can certainly be a viable choice for protecting their pet’s health.

For more insightful articles and tips on pet care and insurance, be sure to explore more at Tech Havela. Your pet’s health is worth it!

**Sidnir Vieira**

Founder of TechHavela

A passionate pet and tech content creator, helping dog owners across the U.S. make smarter decisions for their furry friends.